The purpose of the Small Business Emergency Assistance Program – Phase 3 is to provide short-term, immediate payroll and working capital support to additional New Jersey SMEs that have been negatively impacted during the pandemic, thereby helping to stabilize their operations and minimizing any potential furloughs and/or layoffs.

Under the initial phase of the program, eligibility was restricted to businesses of no more than 10 FTEs. In Phase 2, the employee eligibility cap was increased to no more than 25 FTEs. In Phase 3, the employee eligibility cap is further increased to no more than 50 FTEs.

Of the $70 million in Coronavirus Relief Fund funding available, funds will be reserved for specific types of businesses in the following manner:

- Restaurants: $35 million of funding be reserved to support businesses classified as “Food Services and Drinking Places” with NAICS codes beginning with 722 (described in this document as “Restaurants”), given the disproportionate impact these businesses have experienced due to COVID-19.

- Micro-businesses: $15 million of funding be reserved to support businesses that have had 5 or fewer FTEs in its peak FTE count over the past six quarters of WR-30 filings (including businesses with no FTEs), given the unique financial vulnerability experienced because of COVID-19 by micro-businesses, which typically have lower financial reserves.

- Other small businesses: The remaining $20 million of funding will be reserved to support businesses with 6 to 50 employees.

Funding may be used for reimbursement of lost revenue as a result of business interruption caused by COVID-19 and may not be used for capital expenses, including construction.

All Businesses that apply for this must:

- have a physical location in NJ

- be registered to do business in New Jersey

- be in Department of Labor good standing

- fill out and certify debarment legal questionnaire

- certify to negative impact of emergency

- certify intent to not lay off any workers

Award sizes for “Food Services and Drinking Places” businesses with NAICS beginning with 722:

| FTE Band | Award Size |

|---|---|

| 5 FTEs or fewer, including businesses with no FTEs | $10,000 |

| 6-25 FTEs | $15,000 |

| 26-50 FTEs | $20,000 |

Award sizes for micro-businesses:

| FTE Band | Award Size |

|---|---|

| 5 FTEs or fewer, including businesses with no FTEs | $5,000 |

Award sizes for other small businesses:

| FTE Band | Award Size |

|---|---|

| 6-25 FTEs | $10,000 |

| 26-50 FTEs | $15,000 |

Phase 3 Grant Pre-Registration

Interested business owners will need to pre-register in order to apply. Pre-registration will be open from Monday, October 19th at 9:00 a.m. and will Close Tuesday, October 27th at 5:00 p.m.

Once you have pre-registered, you will need to return to the portal to complete an application based on the following schedule:

Restaurants: Food Services and Drinking Places: NAICS Code must start with 722 – 9:00 a.m. on Thursday, October 29, 2020

Micro businesses: 5 or less Full-Time Equivalent W2 employees or any entity that does not file a NJ-WR30 – 9:00 a.m. on Friday, October 30, 2020 Small Business: More than 5 Full-Time Equivalent W2 employees (excluding restaurants) – 9:00 a.m. on Monday, November 2, 2020

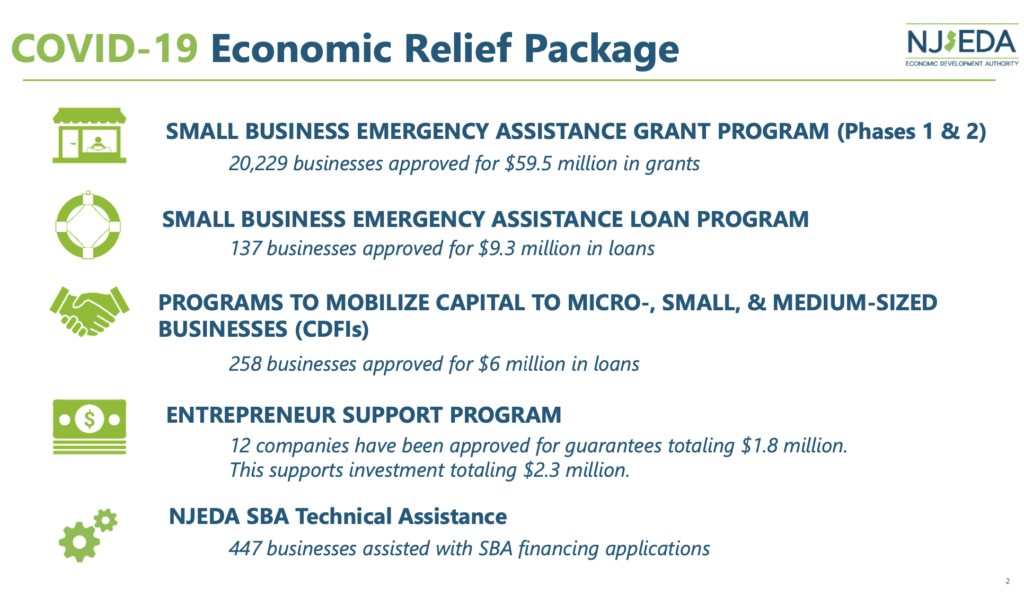

Via NJEDA, prior Economic Relief packages have included:

Don’t miss your chance for additional funding if you qualify.