HOW TO AVOID THE CORPORATE TRANSPARENCY ACT . . . You can’t, but you can make “ownership and control” changes now before the effective deadline of January 2, 2025, thus avoiding having to disclose current owners and controllers. This is your last chance to clean up what you might not want others to know or be able to easily discover.

Unveiling Corporate Transparency

Overview:

As of January 1, 2024, small business entities are required to file with the US Department of Treasury certain ownership information of the entity. Gone are the days of “shell” entities hiding ownership interests, at least, that’s the idea. While this is “nothing new” for our international clients (who’ve been operating under similar regulations for quite some time), it might come as a big shift to our US clients.

In a bid to enhance corporate accountability and curb illicit financial activities, the Corporate Transparency Act (“CTA”) was enacted in the United States. As set forth in the CTA, this landmark legislation is intended to address:

(3) malign actors seek[ing] to conceal their ownership . . . to facilitate illicit activity, including money laundering, … financing of terrorism, … serious tax fraud, human and drug trafficking, counterfeiting, piracy, securities fraud, financial fraud, and acts of foreign corruption, harming the national security interests …;

(4) money launderers … intentionally conduct transactions through corporate structures in order to evade detection, and may layer such structures, much like Russian nesting ‘‘Matryoshka’’ dolls, across various secretive jurisdictions such that each time an investigator obtains ownership records for a domestic or foreign entity, the newly identified entity is yet another corporate entity, necessitating a repeat of the same process;

https://www.federalregister.gov/documents/2022/09/30/2022-21020/beneficial-ownership-information-reporting-requirements

The CTA is a significant shift towards greater transparency in business. Understanding its implications is crucial for business owners navigating the evolving regulatory landscape.

Our insight:

If you have a desire to avoid disclosing your ownership or controlling interest, we’d suggest you make any change in that ownership or controlling interest prior to December 31, 2024. Our reading of the CTA requires the Beneficial Ownership Information (“BOI”) report to be filed by the December 31, 2024, deadline. It does not require disclosure of 2024 transactions prior to that filing. After December 31, 2024, all changes to ownership or controlling interest will have to be disclosed in the normal course of update filings.

The Basics of the Corporate Transparency Act:

The CTA, which was signed into law in January 2021, requires all corporations, limited liability companies, limited partnerships, foreign, and similar entities (LLPs, LLLPs and business trusts) created or registered to do business in the United States (“Reporting Company”) to submit a BOI report to the U.S. Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”).

Timing

- A Reporting Company created or registered to do business before January 1, 2024, will have until January 1, 2025, to file its initial BOI report.

- A Reporting Company created or registered in 2024 will have 90 calendar days to file after receiving actual or public notice that its creation or registration is effective.

- A Reporting Company created or registered on or after January 1, 2025, will have 30 calendar days to file after receiving actual or public notice that its creation or registration is effective.

Reporting

- In sum, the CTA requires that businesses disclose:

- personal

information of every individual who either directly or indirectly:

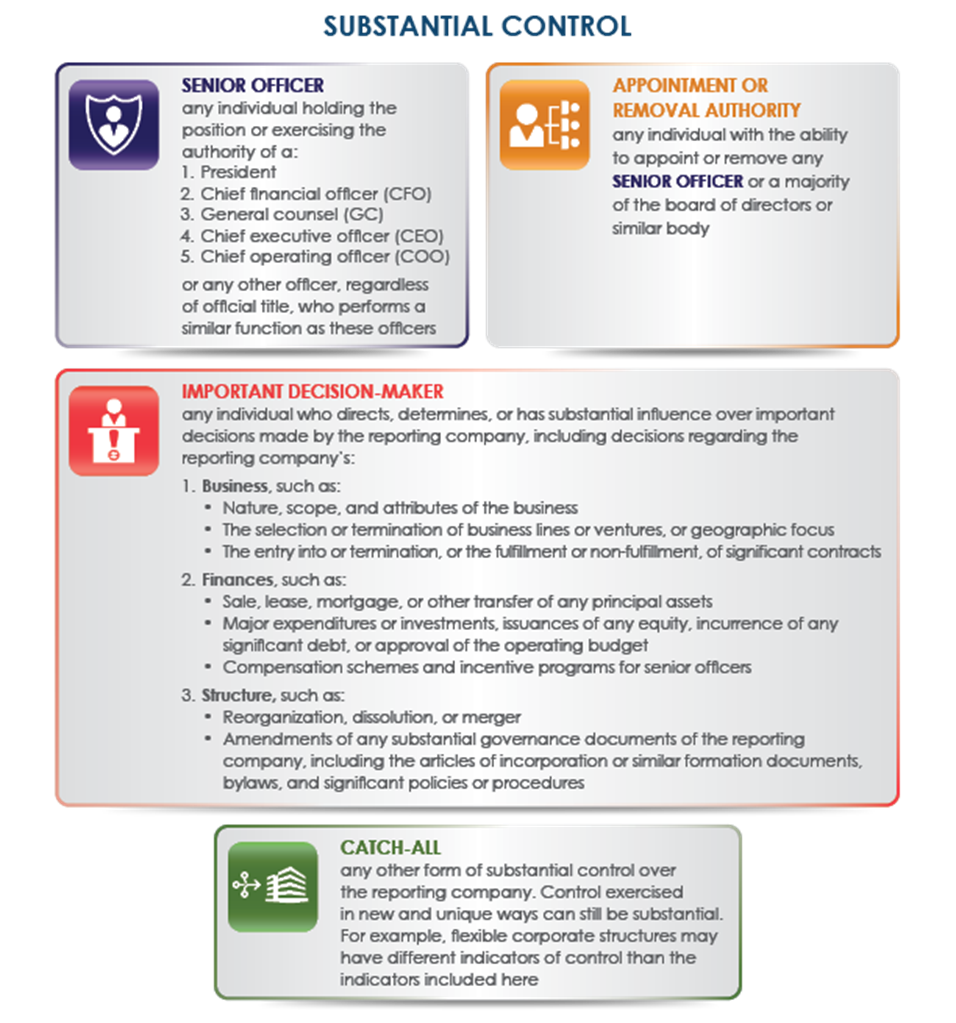

- (1) exercises substantial control (see infographic “A” below) over the reporting company, or

- (2) owns or controls at least 25% of the reporting company’s ownership interests (see infographic “B” below).

- personal

information of every individual who either directly or indirectly:

- “Indirect owner,” is broad, and may involve multiple filings for each entity.

Contents of Report for Beneficial Owners

- Each “beneficial

owner” must provide the following on the BOI report:

- Full Legal Name;

- Date of Birth;

- Current Address;

- The identifying number and issuer from either a non-expired U.S. driver’s license, a non-expired U.S. passport, or a non-expired identification document issued by a State (including a U.S. territory or possession), local government, or Indian tribe. If none of those documents exist, a non-expired foreign passport can be used; and

- An image of the foregoing document.

Exemptions

There are 23 exemptions, the most noteworthy of which are:

- Publicly traded companies meeting specified requirements, many nonprofits, accounting firms, governmental authorities, banks, credit unions, pooled investment vehicles, insurance companies and certain large operating companies and inactive entities.

- The CTA also exempts any entity that:

- Employs more than 20 employees on a full-time basis (only employees of a Reporting Company are used to calculate full time employees);

- Has an operating presence at a physical office within the US (this address may be a subsidiary); and

- Filed in the previous year “federal income tax returns in the United States” demonstrating more than $5,000,000 in gross receipt or sale and gross receipts or sales in the aggregate (including the receipts or sales of other entities owned by the entity; and other entities through which the entity operates)

- The CTA also exempts certain “Inactive entities” which are defined as entities that (a) existed on or before January 1, 2020; (b) are not engaged in active business; (c) are not wholly owned, directly or indirectly, by a foreign person; (d) have not experienced a change of ownership in the preceding twelve months; (e) have not sent or received more than $1,000 in the preceding twelve months; and (f) do not otherwise hold any type of asset, including ownership interest in another entity.

Penalties for Non-Compliance

- It is unlawful for any person to willfully

provide (or attempt to provide) false or fraudulent Beneficial Ownership

Information or to willfully fail to report complete or updated Beneficial

Ownership Information.

- Civil penalties include up to $500 for each day the violation continues.

- Criminal penalties of up to $10,000, and/or possible imprisonment of up to two years for each violation.

Other Considerations

- The BOI reports and the information disclosed in those reports will not be publicly available. Generally, BOI information will only be disclosed to: (i) federal and state law enforcement agencies in specified circumstances; and (ii) with the reporting company’s consent, to financial institutions in connection with their know-your-customer (KYC) obligations.

- Enhanced Compliance Obligations: Business owners must ensure compliance with the new reporting requirements. Failure to disclose accurate and timely information could result in penalties and legal consequences.

- Operational Adjustments: Compliance with the CTA may necessitate operational adjustments for businesses, including updating internal processes and systems to facilitate accurate reporting to FinCEN.

- Mitigating Risks: By identifying and disclosing beneficial ownership information, businesses can mitigate risks associated with illicit activities such as money laundering and fraud. Enhanced transparency can also foster trust among stakeholders and investors.

- Global Implications: While the CTA is a domestic regulation, its implications extend beyond U.S. borders. Foreign entities conducting business in the U.S. may also need to comply with the act’s provisions, further emphasizing the importance of transparent business practices on a global scale.

Recommendations:

First, if you have a desire to avoid disclosing your ownership or controlling interest, make any change in that ownership or controlling interest prior to December 31, 2024. Our reading of the CTA requires the BOI to be filed by the December 31, 2024, deadline. It does not require disclosure of 2024 transactions prior to that filing. After December 31, 2024, all changes to ownership or controlling interest will have to be disclosed in the normal course of update filings.

Next, and overarching, we recommend that all companies establish record keeping and CTA compliance processes, which should involve the following:

- Internal procedures to record the names and ownership information of

entities as they are formed, and as they are dissolved or sold;

- A process for (1) identifying the company “applicant” as defined in the CTA, which generally refers to one or two individuals that form or register the entity, and (2) obtaining the required information, including a copy of a qualifying form of identification;

- A process for monitoring and tracking any changes in information that will require the updating of CTA-related filings;

- Revision of entity formation documents and entity governance documents to

permit each company to collect CTA-related information from its beneficial

owners, including but not limited to:

- A representation by each shareholder, member or partner, as applicable, that it is compliant with, or exempt from, the CTA;

- A covenant by each shareholder, member or partner, as applicable, requiring continued compliance with and appropriate disclosures under the CTA, or to provide evidence of exemption from its requirements;

- Indemnification agreements by each shareholder, member or partner, as applicable, of the company and its shareholders, members or partners, for any failure to comply with the CTA or for providing false information; and

- A consent by each beneficial owner or controlling person for the company

to disclose identifying information to FinCEN, to the extent required by law.

- A determination whether it is appropriate for individuals who have a role in the formation of new entities to obtain a FinCEN identifier, to assist in protecting privacy and facilitating the updating of beneficial ownership reporting; and

- Implementation of a process to timely file updated ownership reports.

Compliance with the CTA will require regular and at least annual attention going forward. We recommend that you create an internally responsible person and process to ensure appropriate record-keeping and CTA filings.

Conclusion:

The Corporate Transparency Act represents a significant step towards combating financial crime and promoting corporate accountability. For business owners, understanding and complying with the CTA’s requirements are essential to navigate the evolving regulatory environment effectively. While the CTA presents challenges such as increased compliance obligations, embracing transparency can ultimately strengthen trust, mitigate risks, and contribute to a more resilient and ethical business ecosystem. If you have any questions or would like to learn more about the CTA and any reporting requirements, please contact The McHattie Law Firm. We’re more than happy and capable to assist with your reporting obligations.

Infographic “A”- Beneficial Owner with Substantial Control

Infographic “B”- Beneficial Owner Ownership Interest